Digital comic book sales in 2014 top $100 million as market hits 20 year high!

According to market analysts Comichron and ICv2, the comics industry hit a 20 year high for graphic novel and comic book sales in 2014, with digital comics now comprising a whopping 10% of the US and Canadian market. The report, published by Comichron’s John Jackson Miller and ICv2’s Milton Griepp estimate total comics and graphic novel sales to consumers in the U.S. and Canada reached $935 million in 2014, a 7% increase over sales in 2013 – and the highest it’s been since the heady days of the mid-1990s!

According to market analysts Comichron and ICv2, the comics industry hit a 20 year high for graphic novel and comic book sales in 2014, with digital comics now comprising a whopping 10% of the US and Canadian market. The report, published by Comichron’s John Jackson Miller and ICv2’s Milton Griepp estimate total comics and graphic novel sales to consumers in the U.S. and Canada reached $935 million in 2014, a 7% increase over sales in 2013 – and the highest it’s been since the heady days of the mid-1990s!

“It’s a very exciting time in the comics business,” Griepp said. “The broad range of titles being published, the wide variety of places they’re sold, and the great exposure comics are getting from other media are all very positive for the industry.”

“The market’s in great shape,” Miller said. “According to our tracking at Comichron, 2014 was the biggest year for print since 1995, adjusting for inflation; without adjusting for inflation dollar sales hit a mark unseen since 1993. And digital appears to be complementing, rather than cannibalizing, print.”

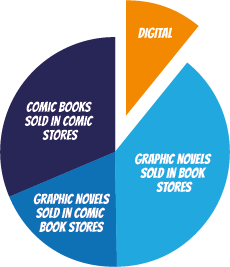

With superheroes now firmly in the mainstream this has seen a knock on effect to comic book sales with increases spread across all three formats. Print grew $55 million to $835 million in 2014, or around 7% more than the $780 million in print sales in 2013. That growth occurred in every channel and format except newsstand sales of periodical comics, which declined from $25 million to $20 million as Marvel withdrew from the market.

Sales of periodical comics through comic stores grew 4%, from $340 million to $355 million. Sales of graphic novels through comic stores grew at a slightly faster pace, from just under $170 million to just over $175 million.

The book channel (bookstores, online, mass) was where the greatest growth was, with graphic novel sales in the book channel up 16%, from $245 to $285 million.

Download-to-own digital sales reached $100 million in 2014, but the growth rate declined to around an 11% increase over 2013’s $90 million in sales, compared to a 29% growth rate in 2013.

So despite a slower growth rate in 2014 than in 2013, the signs of strength were broad, across channels and formats, a positive sign for the industry.

As presented above and in the accompanying infographic, the 2014 analysis by ICv2 and Comichron was divided up between periodical comics (what some call “floppies” or “pamphlets”), graphic novels, and digital download-to-own sales. All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription or “all you can read” services.

This is the second joint market size analysis from ICv2 and Comichron; the first was last year for 2013 sales.

December 20, 2025 @ 12:28 am

Mitunter sind es mehrere Tausend Spielautomaten, die man auf diese Weise

kennenlernen und ohne Einsatz von echtem Geld spielen kann.

Hier muss man sich nicht zwangsläufig registrieren, um gratis spielen zu können. Dem wollen die Regierungsverantwortlichen entgegen wirken, indem sie

Gratisslots im Online Casino Deutschland verbieten.

Keno, beispielsweise ist ein Glücksspiel in der Art eines Lottospiels, bei dem die Spieler eine Reihe von Zahlen aus einem vorgegebenen Bereich

auswählen. Seine zeitlose, elegante Schlichtheit macht

es zu einem Lieblingsspiel vieler Spielerinnen und Spieler.

Online Baccarat ist ein Kartenspiel, bei dem die Spieler auf das Ergebnis zweier Kartenhände,

jene des Spielers oder des Dealers, ihre Einsätze tätigen. Ziel des Spiels ist es, die bestmögliche Pokerhand zusammenzustellen, wobei die

Auszahlungen auf der Stärke der erhaltenen Kartenhand basieren. Online Roulette stellt den Nervenkitzel des berühmten Casino- Tischspiels nach,

allerdings in digitaler Form. Sowohl Neueinsteiger als

auch erfahrene Spieler lieben dieses Kartenspiel wegen seiner einfachen Spielregeln, seiner

strategischen Tiefe und der Möglichkeit, während

des Spiels fundierte und durchdachte Entscheidungen zu treffen.

References:

https://online-spielhallen.de/smokace-casino-deutschland-ein-tiefenblick-fur-spieler/

December 26, 2025 @ 4:42 pm

Online casinos are designed for fun, and while winning is

exciting, it’s never guaranteed. Top operators offer 24/7

live chat and quick email replies. A trustworthy casino provides clear and fair

terms. Most Aussies prefer to play on their smartphones or tablets.

Reliable casinos operating in Australia are usually regulated by respected authorities such as Curaçao

eGaming or Malta Gaming Authority. Picking the wrong one can mean slow payouts,

unclear bonus rules, or even unsafe banking.

You can filter by provider or simply search for the game you want to play.

These are some of the fun games to explore. Now it’s time to

complete the SkyCrown casino login in Australia and start playing.

References:

https://blackcoin.co/roll-xo-online-casino-official-site-with-pokies-and-games/

December 27, 2025 @ 8:23 am

First of all, SkyCrown works with all the best live providers such as

Pragmatic Play Live, Evolution Gaming, Ezugi, Lucky Streak,

Playtech and Authentic Gaming. And of course there is the option to filter games based on provider.

Some other gambling sites should whip out

their pens and take notes about the way SkyCrown is presenting the games.

With over 7,000 games and a fast 10-minute payout time, Skycrown delivers top-notch entertainment

for Aussies eager to explore. Casino.guru is an independent source of information about online casinos and online casino games, not

controlled by any gambling operator. A platform created to showcase all of our efforts aimed at

bringing the vision of a safer and more transparent online gambling industry to reality.

December 29, 2025 @ 7:34 am

online casinos paypal

References:

recrutement.fanavenue.com

December 29, 2025 @ 8:00 am

online real casino paypal

References:

ehrsgroup.com