Contribution Margin Ratio Formula Per Unit Example Calculation

You work it out by dividing your contribution margin by the number of hours worked. As of Year 0, the first year of our projections, our hypothetical company has the following financials. One common misconception pertains to the difference between the CM and the gross margin (GM).

Setting Realistic Sales Targets

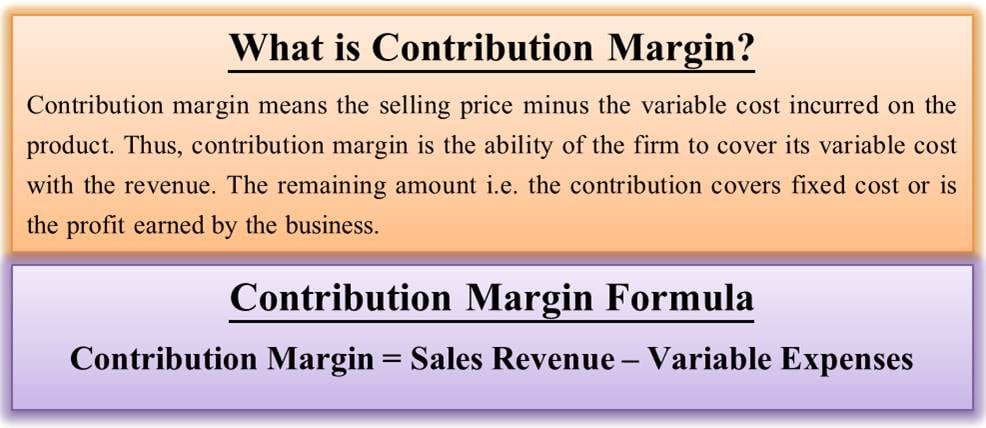

However, the contribution margin for selling 2000 packets of whole wheat bread would be as follows. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve. As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better.

Contribution Margin Formula Components

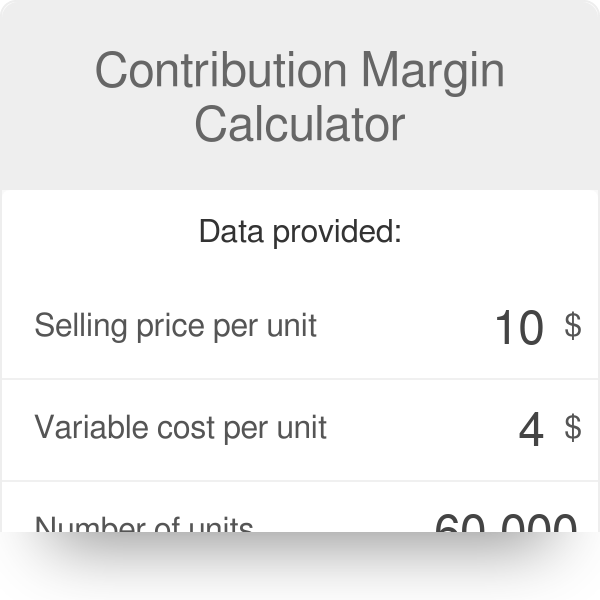

This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not how to build value stream maps using kanban considered in the contribution margin calculations. The contribution margin is computed as the selling price per unit, minus the variable cost per unit.

Contribution Margin Formula

A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold. While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior.

We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin.

- Contribution margin is the variable expenses plus some part of fixed costs which is covered.

- Management uses the contribution margin in several different forms to production and pricing decisions within the business.

- A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales.

- As a result, a high contribution margin would help you in covering the fixed costs of your business.

The following are the steps to calculate the contribution margin for your business. And to understand each of the steps, let’s consider the above-mentioned Dobson example. This means Dobson books company would either have to reduce its fixed expenses by $30,000. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000.

That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated.

The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases.