6 4: Comparing Absorption and Variable Costing Business LibreTexts

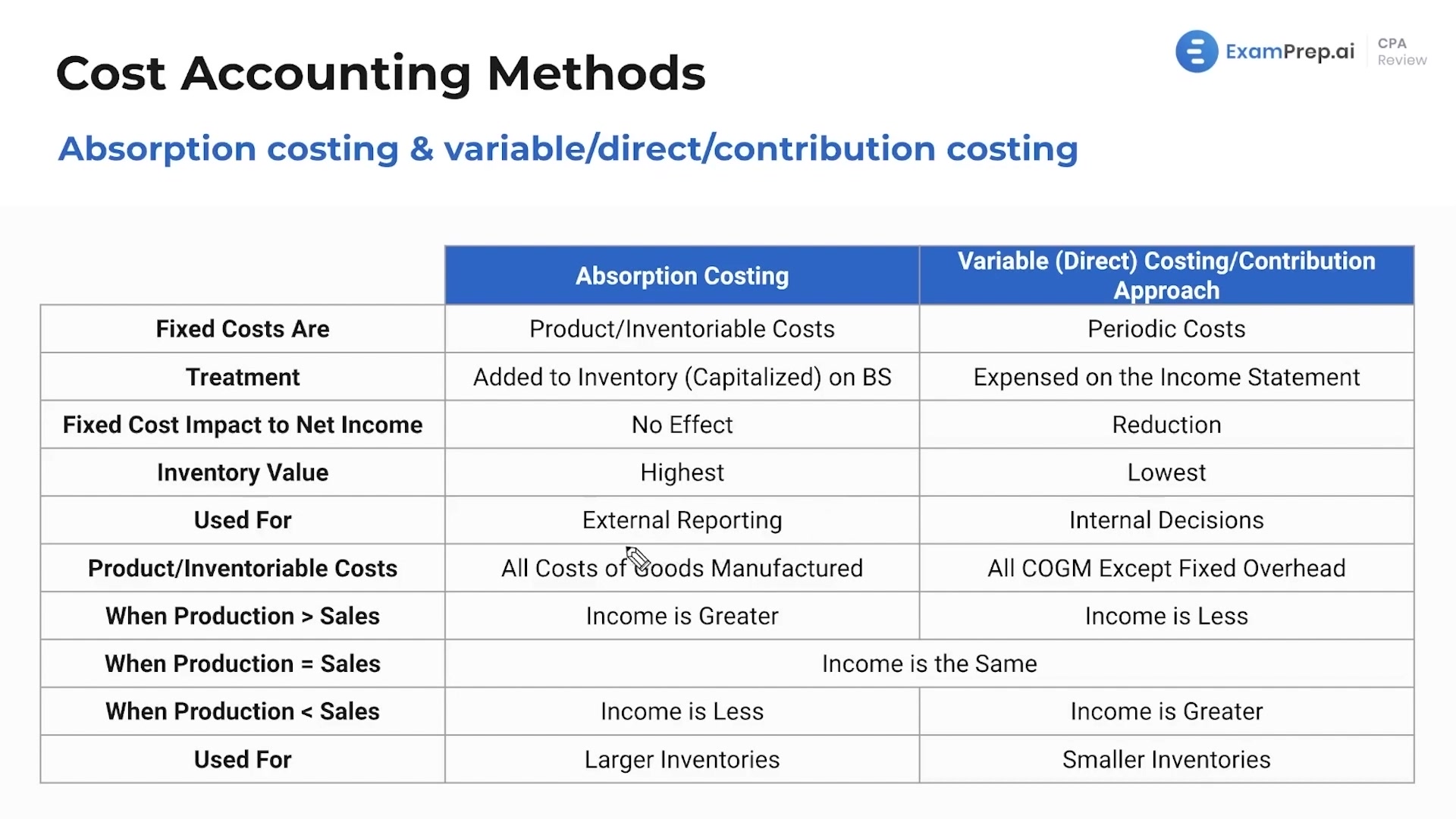

While both methods are used to calculate the cost of a product, they differ in the types of costs that are included and the purposes for which they are used. The differences between absorption costing and variable costing lie in how fixed overhead costs are treated. Both Absorptions costing and variable cost have a relationship with fixed overhead costs. However, while absorption costs shared fixed overhead costs into various units produced within a particular period, variable costing sums them all together.

Variable Costing Versus Absorption Costing Methods

It’s also known as complete costing because it accounts for all direct manufacturing costs, including labor, raw materials, and any fixed or variable overheads. In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period. Since inventory costs are not expensed until sold, the two income statements will give different operating income. With a higher COGS under absorption costing, gross margin is lower compared to variable costing. Tracking both types of costs allows companies to understand the full cost of production under absorption costing principles aligned with GAAP. The overhead absorption rate is an important concept in management accounting.

Understanding Goodwill in Balance Sheet – Explained

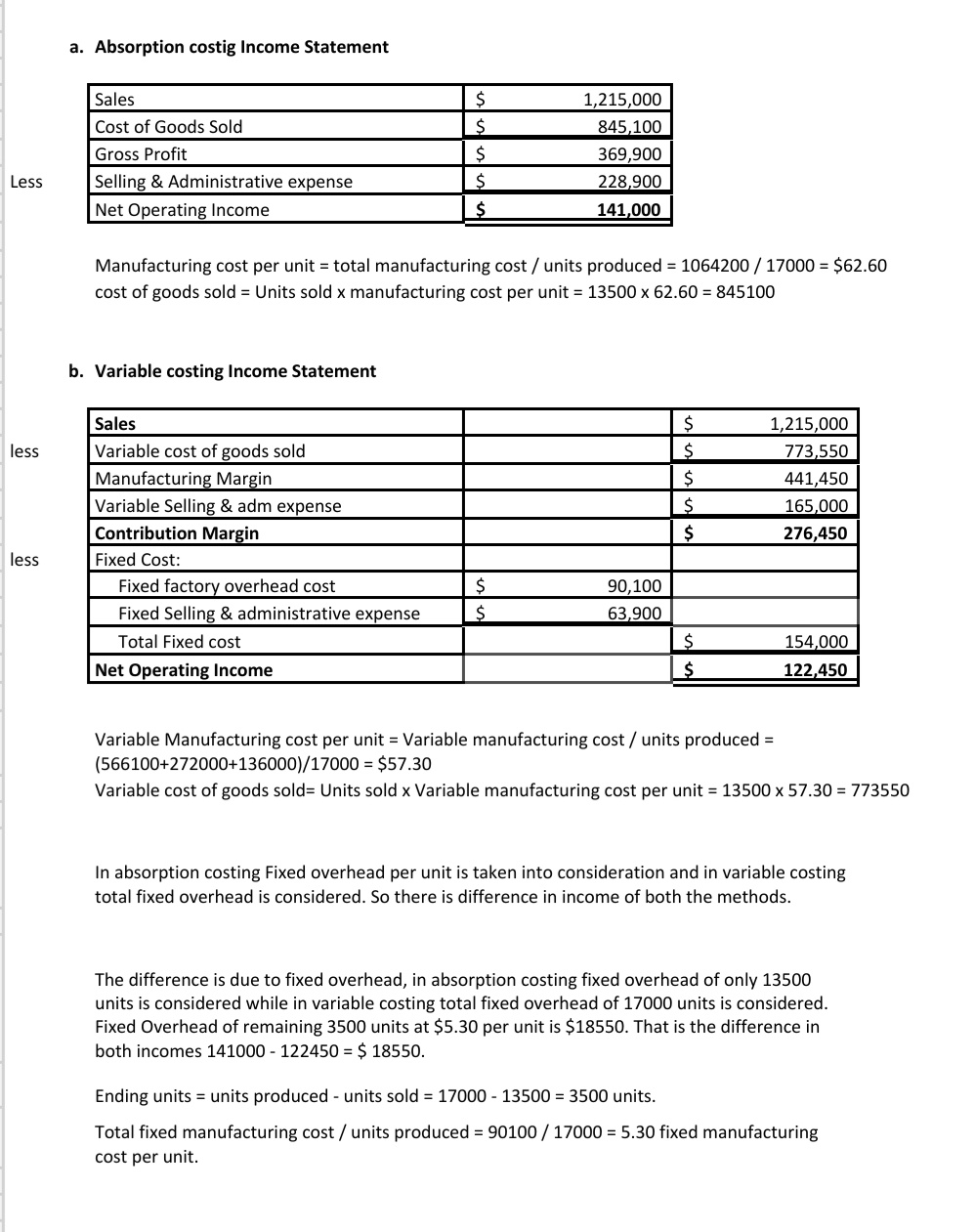

The key difference in calculating the income statement under absorption costing versus variable costing is in how fixed manufacturing costs are handled. The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead costs). As 8,000 widgets were sold, the total cost of goods sold is $56,000 ($7 total cost per unit × 8,000 widgets sold). The ending inventory will include $14,000 worth of widgets ($7 total cost per unit × 2,000 widgets still in ending inventory). Does not meet GAAP requirements – under GAAP product costs are not expensed in the period incurred, they become inventory. Next, we can use the product cost per unit tocreate the absorption income statement.

Overhead Absorption Rate Formula

Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product. In addition to the fixed manufacturing overhead costs, absorption costing also includes the variable manufacturing costs in the cost of a product. These costs are directly traceable to a specific product and include direct materials, direct labor, and variable overhead.

Understanding Absorption Costing

Absorption costing “absorbs” all of the costs used in manufacturing and includes fixed manufacturing overhead as product costs. Absorption costing is in accordance with GAAP, because the product cost includes fixed overhead. Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product.

It is also known as a managerial account used to cover all expenses made on a particular product. Therefore, an absorption cost includes all direct and indirect costs, including labor, rent, insurance, etc. Absorption costing is a method of costing that includes all manufacturing costs, both fixed and variable, in the cost of a product. Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively.

But absorption costing net income is viewed as more accurate since it allocates all production costs. Revenue is recorded in the same way under both absorption costing and variable costing. It reflects the sales made during the period at the price agreed upon with customers. There is no difference in revenue recognition between the two costing methods. This cost includes direct production costs like materials and wages as well as a share of fixed costs allocated to each unit.

Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines. Full absorption costing–also called absorption costing–is an accounting method that captures all of the costs involved in manufacturing a product. The main idea and intention behind using such a absorption costing method for costing purpose is to imply that a product, when produced, absorbs both fixed and variable cost up to a certain extent. It does not depend on the fact that the unit of the product has been sold or it is still lying in the storage as inventory or finished product ready to be sold.

- This eliminates the distinctions between fixed and variable costs, thereby reflecting the impact of overhead on manufacturing.

- When doing an income statement, the first thing I always do is calculate the cost per unit.

- These profits only differ in the presence of an opening and closing inventory.

- The key difference in calculating the income statement under absorption costing versus variable costing is in how fixed manufacturing costs are handled.

- It does not include a portion of fixed overhead costs that remains in inventory and is not expensed, as in absorption costing.

The absorption rate is usually calculating in of overhead cost per labor hour or machine hour. The products that consume the same labor/machine hour will have the same cost of overhead. Absorption costing is the accounting method that allocates manufacturing costs accounting and finance mcq quiz with answers test 1 based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period. Since COGS is higher under absorption costing, net income is lower compared to variable costing.

If less than the budgeted units were manufactured, then we would have to add them to the cost of sales. Sales revenue was calculated by multiplying sold units (140,000) by the selling price ($10) to arrive at $1400,000. Adjustments are made for the level of output differences if the actual output level is higher or lower than the normal output level. The amount of over-absorption is deducted from the total cost of items created and sold if the actual output level exceeds the typical output level.